The Relationship Between Credit and Income

“Wealth is not his that has it, but his that enjoys it” - Seneca

Introduction:

In today's fast-paced world, understanding your personal finances can feel overwhelming. With so many different aspects to manage---from paying bills to building savings---its's easy to get lost. But what if you could simplify it all down to two core pillars?

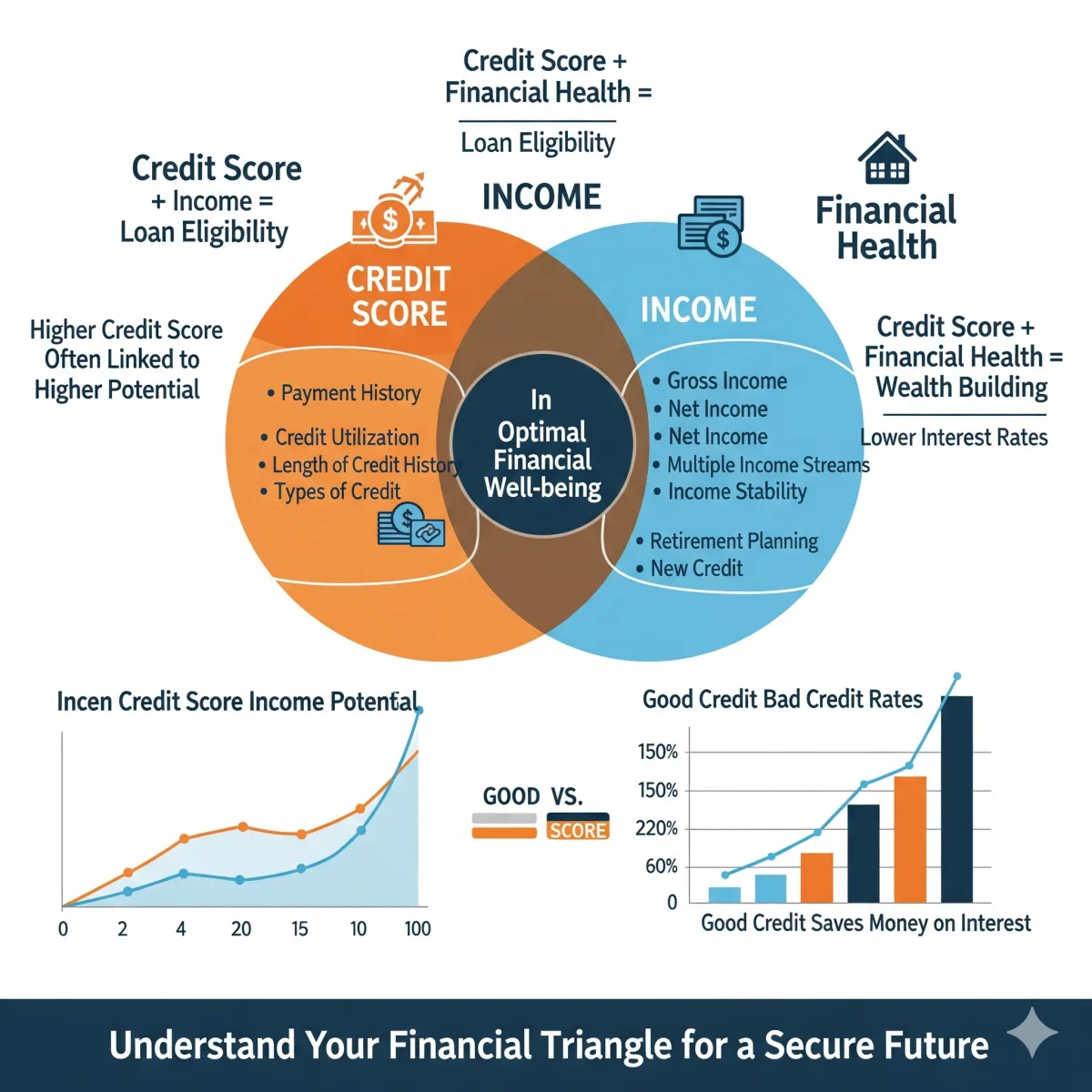

This blog post, supported by a powerful visual guide, will explore the essential and often misunderstood relationship between credit and income. We'll show you why a healthy understanding of both is the key to securing your financial future, helping you movie from simply earning a living to building lasting wealth.

Unlocking Your Financial Future

Understanding the intricate relationship between credit and income is pivotal for anyone looking to secure their financial future and transition from just making ends meet to building enduring wealth. In this blog post, we will delve into why a comprehensive grasp of both credit and income is essential for optimal financial wellbeing and how they can influence each other in more ways than one might expect.

Credit: The Gateway to Financial Opportunities

Credit is more than just a number; it's a representation of your financial reliability. A credit score, which ranges from 300 to 850, is a metric that lenders use to evaluate the risk of lending money to an individual. A higher score is indicative of a trustworthy borrower and can open doors to lower interest rates, which can save you thousands of dollars over a lifetime. But what factors contribute to a credit score? Payment history, credit utilization, length of credit history, types of credit, and new credit all play significant roles.

The Higher Score Linked to Higher Income Phenomenon

It's often assumed that a higher income naturally leads to a higher credit score. While income is not a direct factor in calculating credit scores, it does influence your financial behavior, which can, in turn, affect your credit. Individuals with higher income levels tend to have more access to credit and can manage their credit utilization more effectively. Additionally, they may have greater income stability, which allows them to make consistent payments and maintain a positive payment history.

Income: The Foundation of Financial Health

Income, whether it's gross income or net income, is the bedrock of your financial health. It's the fuel that powers your ability to pay for daily expenses, save for retirement, and invest in wealth-building opportunities. Having multiple income streams can further enhance your financial stability, making you less vulnerable to economic downturns and unexpected expenses.

The Synergy of Credit and Income in Wealth Building

The synergy between credit and income is most apparent when it comes to wealth building. Good credit can provide access to capital for investments, such as real estate or stocks, at more favorable terms. This means that with lower interest rates, you're spending less on debt and can allocate more funds toward investments that grow over time. Conversely, a stable and increasing income can support a solid credit foundation by enabling timely payments and the ability to take on new credit responsibly.

Income Stability and Retirement Planning

Income stability is crucial for long-term planning, especially when it comes to retirement. A consistent income stream allows for regular contributions to retirement accounts, which can be compounded over time to create a significant nest egg. A good credit score can contribute to retirement planning by making it easier to secure loans for investment properties or business ventures that can provide additional income streams in your later years.

Optimal Financial Wellbeing: A Balance of Credit and Income

Achieving optimal financial wellbeing requires a balance between maintaining a strong credit score and cultivating a robust income. It's not enough to have one without the other. A high income with poor credit may limit your financial opportunities, while good credit with a low income may not suffice to achieve your wealth-building goals.

In conclusion, the relationship between credit and income is undeniably complex, yet it is fundamental to securing a prosperous financial future. By understanding how to leverage both to your advantage, you can move from merely earning a living to creating a legacy of wealth. It's important to remember that this journey is not a sprint but a marathon, requiring diligence, strategic planning, and a commitment to continual financial education. With the right mindset and tools, you can ensure that your credit and income work in tandem to unlock the doors to financial success and stability.

Ready to take the next step on your financial journey? Schedule a free, no-obligation consultation today to discuss your goals and create a personalized roadmap to financial freedom! Call us at +1 901-621-3159 or Book Here